In the fast-paced world of business, mobility is often key to success. Whether you operate a single vehicle or manage an entire fleet, ensuring the safety of your assets on the road is paramount. This blog explores the critical role of commercial auto insurance in safeguarding your business, providing peace of mind as you navigate the highways and byways of commerce.

The Roadmap to Security: Commercial Auto Insurance Unveiled

- Coverage Beyond Vehicles:

- Commercial auto insurance is more than just coverage for your vehicles; it’s a comprehensive shield for your business. It extends protection to your assets, employees, and the very essence of your operations.

- Holistic Coverage for Business Mobility:

- From company cars to delivery trucks, commercial auto insurance from reputable providers covers a wide array of vehicles. It ensures that your business can move forward, securely and efficiently.

- Addressing Road Risks:

- Unforeseen incidents on the road, such as accidents, theft, or damages, can pose significant threats to your business. Commercial auto insurance steps in, providing financial protection against these road risks.

- Tailoring Coverage to Your Fleet:

- Every business is unique, and so is its fleet. Commercial auto insurance allows you to tailor coverage to the specific needs and size of your fleet, ensuring that you’re neither underinsured nor overburdened with unnecessary coverage.

- Proactive Risk Mitigation:

- Beyond reactive coverage, commercial auto insurance encourages proactive risk mitigation. By promoting driver safety initiatives and providing incentives for safe driving practices, it contributes to a safer work environment on the road.

How Capitol Benefits Can Help: Navigating the Road to Protection

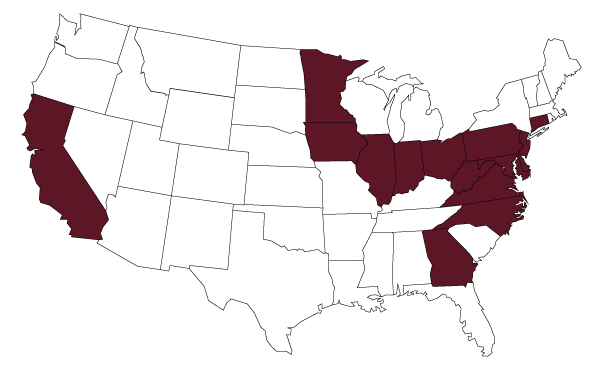

In the journey towards safeguarding your business on the road, Capitol Benefits stands out as a trusted partner. Through our partnership with Erie, Travelers, Hartford, and Liberty Mutual, our commercial auto insurance solutions are designed to go beyond standard coverage, offering:

- Tailored Policies: Capitol Benefits understands that one size doesn’t fit all. Our expert advisors work with you to tailor policies that align with your unique business needs and fleet requirements.

- Efficient Claims Processing: In the event of an incident, Capitol Benefits ensures a streamlined claims process, minimizing disruptions to your business operations and allowing you to get back on the road swiftly.

- Dedicated Customer Service: Our commitment goes beyond policies; we prioritize responsive and dedicated customer service. Capitol Benefits is here to answer your queries, provide guidance, and offer ongoing support throughout your insurance journey.

As you drive your business towards success, Capitol Benefits is your reliable companion on the road, providing the protection and support you need. Contact us today to explore how our commercial auto insurance solutions can safeguard your business assets and contribute to the long-term success of your enterprise.