As a homeowner, it’s crucial to understand the impact of your roof’s condition on your insurance premiums. Here’s why your roof’s condition affects your premiums:

1. Increased Risk of Damage: Older roofs are more susceptible to leaks, water damage, and structural issues, leading to a higher likelihood of insurance claims.

2. Severe Weather Vulnerability: With the rise in severe weather events, older roofs are less capable of withstanding storms, hurricanes, and other natural disasters, increasing the risk of significant damage.

3. Higher Repair Costs: Repairing or replacing an older roof is often more expensive due to the extent of the damage and the materials needed. This higher cost contributes to increased premiums.

Should I file a claim to have my roof replaced by the insurance company?

You always have the option of contacting your insurance company to file a claim for a damaged roof. Once you call them, even if they deny your claim, there can be unintended consequences. It’s important to talk to an independent roofing contractor (not the kind that knocks on your door) and get an unbiased evaluation. It is always a good idea to discuss a potential claim with your independent agent before contacting the insurance company.

Filing a roof claim can have several consequences:

1. Increased Premiums: Submitting a claim can lead to higher insurance premiums, as insurers may view your property as a higher risk…even if the claims are weather related.

2. Future Claim Limitations: Multiple claims can result in limitations on future coverage or even policy cancellations.

3. Out-of-Pocket Expenses: Depending on your deductible, you may still have to pay a significant portion of the repair costs out of pocket.

I’m thinking about changing insurance companies and I’m not really sure about the condition of my roof. What should I be aware of?

1. Roof Inspection Requirement: New insurers often require a roof inspection to assess its condition before offering coverage. Many insurance companies now use satellite imagery to evaluate your roof and may deny coverage regardless of age if it is not deemed to be in satisfactory condition.

2. Potential Coverage Denial: If your roof does not meet the new insurer’s standards, your application for coverage may be denied.

3. Coverage Gap Risk: If denied coverage by a new insurer due to a roof inspection failure, you may face challenges returning to your prior carrier, leaving you without coverage.

What are some steps I can take with my roof to lower my insurance premiums?

1. Perform Regular Maintenance: Schedule regular roof inspections and promptly address any repairs to keep your roof in good condition.

2. Know Your Roof’s Age and Condition: Be aware of your roof’s age and expected lifespan. Plan for replacement if it’s approaching the end of its useful life. Do not wait for insurance to replace your roof if it needs to be replaced.

3. Invest in Quality Materials: When replacing your roof, invest in high-quality materials that offer better durability and weather resistance.

What are some of the restrictions that insurance companies place on roof ages?

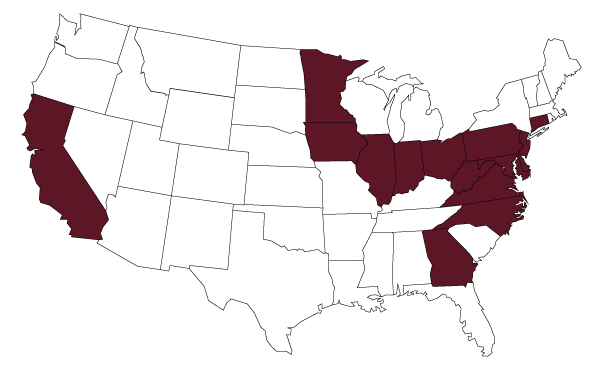

Insurance companies may deny or reduce coverage based on the age of your roof. These guidelines can vary by state, and they are subject to change. Your independent agent can check all your options for you. The guidelines below are meant to give you a general understanding of how some insurance companies may restrict coverage based on roof age. All insurance companies will require that your roof be in good condition regardless of age.

Capitol Benefits Is Here To Help!

At Capitol Benefits, we understand how important it is to have the right coverage for your home. Our team is here to review your currently policy, explore options with over 50 top-rated carriers, and ensure you get the best protection at competitive rates.

Email us at info@capitolbenefits.com to learn how we can help safeguard your home – and your budget!