In the insurance world, you will find two types of agents: Independent insurance agencies and captives. In this article, we share the benefits of choosing an independent insurance agent for all your insurance needs.

In the insurance world, you will find two types of agents to choose from: independent and captive (meaning they work directly with one insurance company). Full disclosure: we are an independent insurance agency. (Learn more about Capitol Benefits here)

Independent agents offer more flexibility because they work with many insurance companies, enabling them to find you the best options.

What Is an Independent Insurance Agent?

While most agents work with only one insurance company, independent Insurance Agents can offer you coverage from many companies and be unbiased in their recommendations. They also can sell personal lines of coverage like auto and homeowners insurance and life and health coverage.

Many people find it beneficial to speak with a local independent agent because they can provide personalized attention and advice based on your needs rather than simply trying to sell you something quickly.

Additionally, when you buy an insurance policy through a trusted independent agent, they will know how to help you if there is a problem. Finally, the best part about working with an independent agent is that it will likely cost less!

Why Hire an Independent Agent?

There are several reasons why you should hire an independent insurance agent. First of all, they are more accessible. Unlike most insurance companies, they do not have a centralized office where customers can come in and speak to someone about their policies; this means that if there is ever a problem or question, there is always an individual there to answer it for you, day, or night.

Another reason to hire an independent agent is that it is less expensive. With independent agents, you will pay less than half of what you would if you went through the company directly. Your local agent does not have as many overhead costs as a large corporation. Independent agents work hard to find competitive rates, constantly looking for new and better deals from other carriers to get you lower rates.

Better Customer Service

Choosing an independent insurance agent means getting better customer service. Unfortunately, most people are not used to dealing with agents because their current insurance company has conditioned them to feel like they are talking to a robot when they call. Still, your independent agent wants nothing more than for you to be satisfied with them and their services.

More Options with Multiple Carriers

Independent insurance agents are a better choice simply because they provide you with options. You might not know your best option, but your independent agent will be able to show you all the different plans available to you so that you can decide which one is best for your needs.

How Do Independent Agents Make Buying Insurance Easier?

Most independent insurance agents will undertake the legwork and research necessary to get the best policy for your needs. In addition, they will answer any questions about coverage, including those you might not have thought of, such as how liability coverage affects your homeowner’s or renter’s policies.

If you cannot find a good fit with one agent, many firms allow you to shop around until you find the right one. Finally, most independent agents are happy to meet you and discuss your options in person. So rather than being on the phone or exchanging emails, you can talk face-to-face about your situation and what type of coverage would be best for you.

How To Find the Perfect Independent Agent

The Independent Insurance Agents & Brokers estimates that there are roughly 36,500 independent insurance agencies in the United States as of their 2018 Agency Universe Study. Therefore, finding the perfect independent insurance agent can be tricky. Considering that, here are some tips to help you out.

Start by checking the NCCI (National Council of Compensation Insurers) website for a list of agents in your area. On this site, you can find agents specializing in different areas, such as auto, home, or life insurance.

If you need car insurance, go to the Auto tab and type in your zip code, and you will get listed companies with locations and contact information for agents. Next, call or email each company to see if they have openings for new clients and what type; you could also ask about any special rates or discounts that might apply if you sign up with them.

Once you have narrowed the list down, talk to a couple of agents from the company(s) you are considering. There is no better way to compare them than hearing from two people at once!

Making The Shopping Experience A Breeze

The perfect insurance agent will make the insurance shopping experience easy for you and not turn it into a nightmare. An independent agent will help you resolve a claim issue in a couple of days.

The best insurance agent will keep their customers coming back no matter what stage in their life they enter. Moreover, since they can offer quote rates from various sources, they will provide you with the best possible offer, making your shopping experience a breeze.

This agent will provide an excellent experience and shoot for lasting relationships and a better reputation in the business.

Since coverage, policies, and rates can be challenging to understand; the independent agent will help you understand these confusing terms. Additionally, they will build a personal relationship with you to ensure you know how the process goes and what the options, limits, and coverages are to ease your worries.

What Type of Insurance Should You Choose?

Since people have no control over the unexpected and the unknown, insurance is there to help them protect themselves and their families in case of an accident. Of course, the market offers various types of insurance available, but the real question is how much you should spend and what insurance type you need.

Many factors influence your choices, such as age, lifestyle, employment, children, living space, and living place.

Any agent will recommend four main types of insurance: health, auto, life insurance, and long-term disability.

Health insurance protects you in times of illness or accident, and auto protects you from the finances in case of a car accident. Long-term disability covers you if you meet an unexpected income loss, and life insurance will protect any of your family members if you suddenly die.

By Coverage Type

The coverage type of insurance protects individuals from any risk or liability.

The main types of coverage include collision, liability, and comprehensive coverage.

By Business Type

Business insurance is there to protect businesses from losses. These losses can happen due to an accident as a part of the ordinary business course.

The business insurance policies include coverage for legal liability, property damage, or other job-related risks.

Auto & Vehicle Insurance

Auto insurance is the coverage you get if you face financial loss in times of accident/theft. This deal is between you and an insurance company, and it is a contract that vehicle owners purchase to mitigate any costs related to car accidents.

Home & Property Insurance

Home and property insurance protects you in case of an accident or damage to your home. It is a policy that protects the policyholder from unforeseen damage or loss in the house.

So, it protects you against any damage to your property and belongings from any perils.

Home insurance covers any destruction to the interior and exterior of the residence and any loss of possessions or theft.

Regarding home insurance, you can choose from replacement cost, actual cash value, and extended replacement cost.

Final Words

If you are interested in an independent agent, you can contact our suggested insurance agents now. These agents will be intermediaries between you and the insurance company you choose.

Since independent agents represent multiple companies, you could expect them to find the best offers for you, whether for policy, prices, or rates.

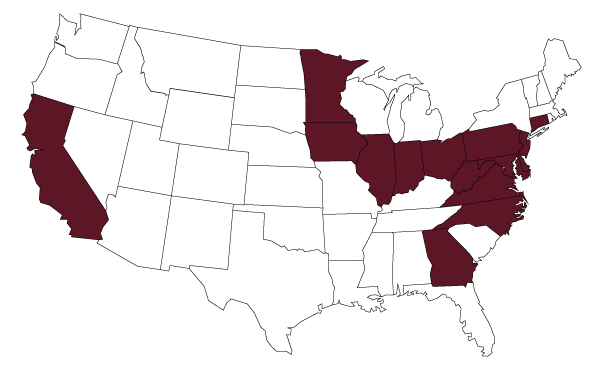

The independent agent offers customized service with local knowledge and support. Do not hesitate to contact us for personalized advice and the best choices. Call us at (301) 431-0000 or schedule an appointment with our team here.

FAQs

What Are the Advantages of Having an Independent Insurance Agent?

Independent agents will be entirely devoted to you. You will receive personalized service, and these agents will try not to let you go to another agency. They will work hard to keep you at their side and do everything, such as answering questions about coverage, rates, or any claims.

What Qualities Should an Insurance Agent Have?

An insurance agent has to be reliable since you place your life safety in their hands. They also need influential personalities and high energy to make you believe they are entirely devoted to you. Agents should be eager to work with you and happy to be your choice, not look like a tired older adult in bed.

What Do Policyholders Need in An Agent?

Most policyholders need a trustworthy agent they can rely on and have confidence in. In addition, people need agents who do their job professionally and are very attentive.

What Is the Main Difference Between Captive and Independent Insurance Agents?

Captive agents have only one agency to work for. The independent agent does not belong to any company but sells policies from various agencies.